79tka Insights

Your go-to source for the latest news and information.

Decoding Marketplace Liquidity Models: A Treasure Map for E-Commerce Success

Unlock the secrets of marketplace liquidity models and boost your e-commerce success. Discover your treasure map to thrive today!

Understanding Marketplace Liquidity: Key Concepts for E-Commerce Growth

Understanding marketplace liquidity is crucial for any e-commerce business looking to thrive in today's competitive environment. Liquidity refers to the ease with which assets can be bought or sold in the market without affecting their price. In an online marketplace, high liquidity typically indicates a large number of buyers and sellers actively engaging in transactions, which can lead to better pricing and faster sales. For e-commerce growth, recognizing the factors that influence liquidity can help sellers optimize their inventory and pricing strategies, ensuring they're competitive while maximizing their profits.

Several key concepts play a role in determining marketplace liquidity. First is the concept of market depth, which refers to the volume of buy and sell orders at various price levels. A deep market suggests that there is a significant volume of products available at various price points, allowing for quicker transactions. Secondly, trading volume is a critical indicator of liquidity; higher trading volumes often signify a healthy marketplace where products move quickly. Finally, understanding the role of market sentiment can help e-commerce businesses anticipate changes in liquidity, as shifts in consumer confidence can directly impact buying behavior.

Counter-Strike is a highly popular first-person shooter game that has captivated gamers around the world. Players can engage in tactical team combat while striving to complete objectives. If you're looking for ways to enhance your gameplay, check out our daddyskins promo code for some great in-game benefits.

How to Optimize Your E-Commerce Strategy with Effective Liquidity Models

In the fast-paced world of e-commerce, businesses must ensure that they maintain sufficient cash flow to adapt to consumer demands and market fluctuations. Effective liquidity models play a crucial role in this process by allowing companies to manage their finances more efficiently. By implementing strategies such as cash flow forecasting and real-time financial analytics, e-commerce businesses can identify trends and adjust their inventory accordingly. This proactive approach not only enhances operational efficiency but also boosts customer satisfaction by reducing out-of-stock situations.

Moreover, integrating technology into your liquidity models can provide deeper insights into your financial health. Utilizing data analytics tools enables businesses to monitor sales patterns and seasonality, giving you the ability to make informed decisions about budgeting and resource allocation. Additionally, consider adopting flexible payment solutions that can enhance liquidity, such as offering multiple payment options or utilizing financing methods like buy-now-pay-later schemes. These tactics not only improve your overall cash flow but also attract a wider customer base, optimizing your e-commerce strategy for long-term success.

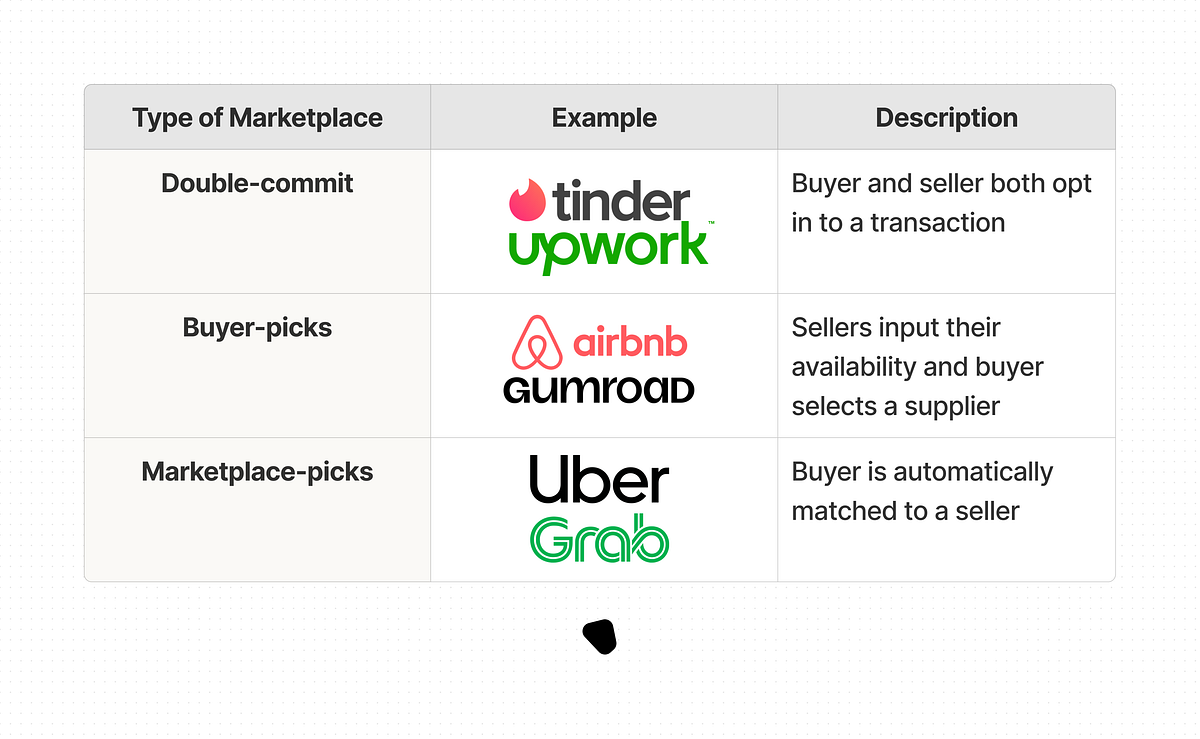

What Are the Different Types of Liquidity Models in E-Commerce and How Do They Affect Sales?

In the realm of e-commerce, understanding liquidity models is crucial for optimizing sales and ensuring a seamless shopping experience. There are primarily three types of liquidity models: order-driven markets, quote-driven markets, and hybrid markets. Each model presents unique ways in which products are bought and sold, influencing everything from pricing dynamics to transaction speeds. In order-driven markets, transactions are facilitated directly by buyer and seller orders, creating transparency and often leading to competitive pricing. In contrast, quote-driven markets rely on designated market makers who provide quotes, thus ensuring liquidity but possibly at the cost of broader price margins.

The choice of liquidity model can significantly impact e-commerce sales performance. For instance, a hybrid market combines elements of both order and quote-driven systems, offering greater flexibility and often attracting a diverse range of consumers. This adaptability can enhance user experience and ultimately drive higher sales volumes. Additionally, the impact of liquidity models is not just limited to pricing; they can also affect inventory levels and supplier relationships. Sellers must carefully evaluate which model suits their business strategy best, taking into account factors like market volatility and demand patterns, to maximize their sales potential.